“Jack & annie’s, a sustainable, animal meat alternative brand made from jackfruit, announced Tuesday $23 million in Series B funding.

The round was co-led by Creadev and Desert Bloom and included participation from Wheatsheaf and existing investors Beta Angels and InvestEco. Company founder and CEO Annie Ryu told TechCrunch the company had not done announcements of previous funding rounds and declined to disclose the company’s total raise to date, but did say this round “ was more than we raised in any prior rounds accumulatively.”

The idea for jackfruit products came to Ryu 10 years ago while she was a medical student at Harvard. She and her brother had started a company, and during a trip to India, were introduced to jackfruit.

Ryu learned that the fruit was drought resistant and high-yielding and while people ate as much as they wanted, she found that 70% of jackfruit went unused. With global health as her background, Ryu had a vision of halting poverty in this area by adding income for farmers by providing an outlet for the fruit to be used. Today, her brands work with 1,000 farming families with 10% to 40% of their income, she said.

She then went about “pioneering the largest supply chain for jackfruit.” The first brand that emerged was The Jackfruit Co. in 2015 to provide foods that harnessed the fruit’s “meaty” texture and, through R&D, a meaty flavor, but packed with nutrients, protein and fiber. Boulder, Colorado-based The Jackfruit Co. sells about a dozen products, mainly targeting vegetarians. It started selling in Whole Foods and has since expanded.

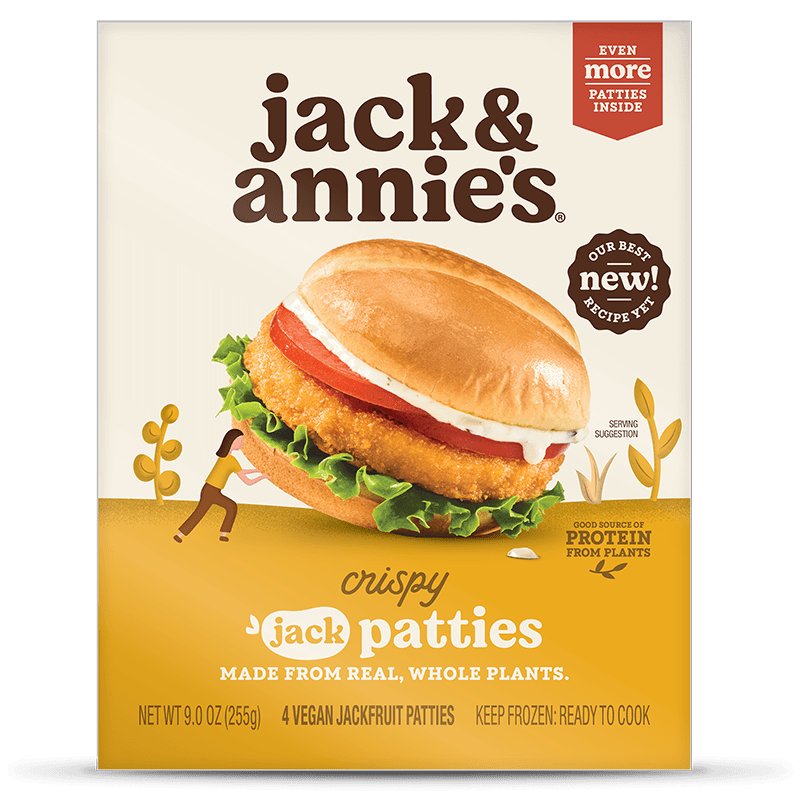

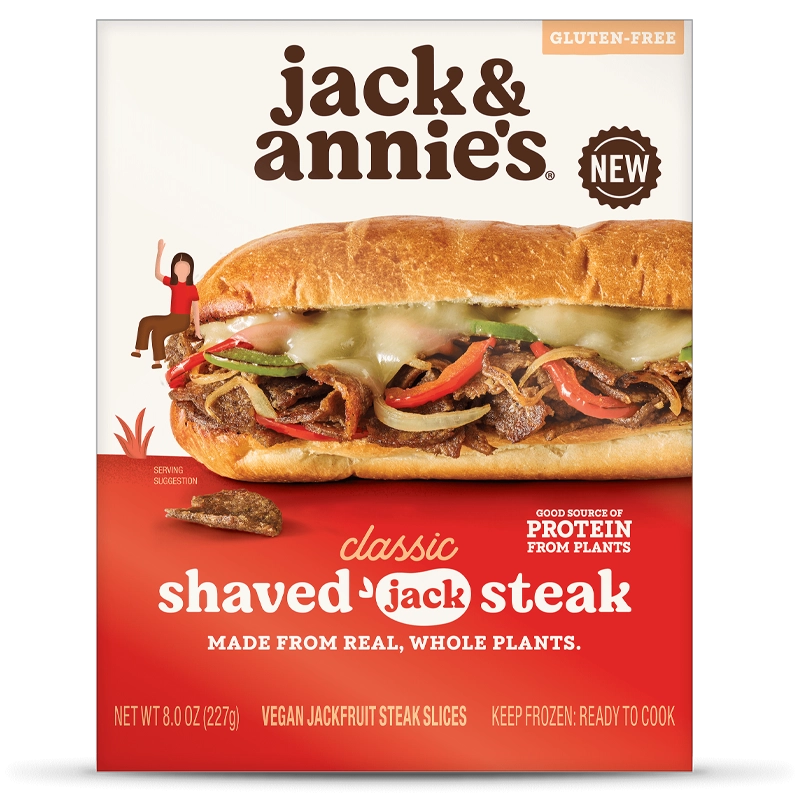

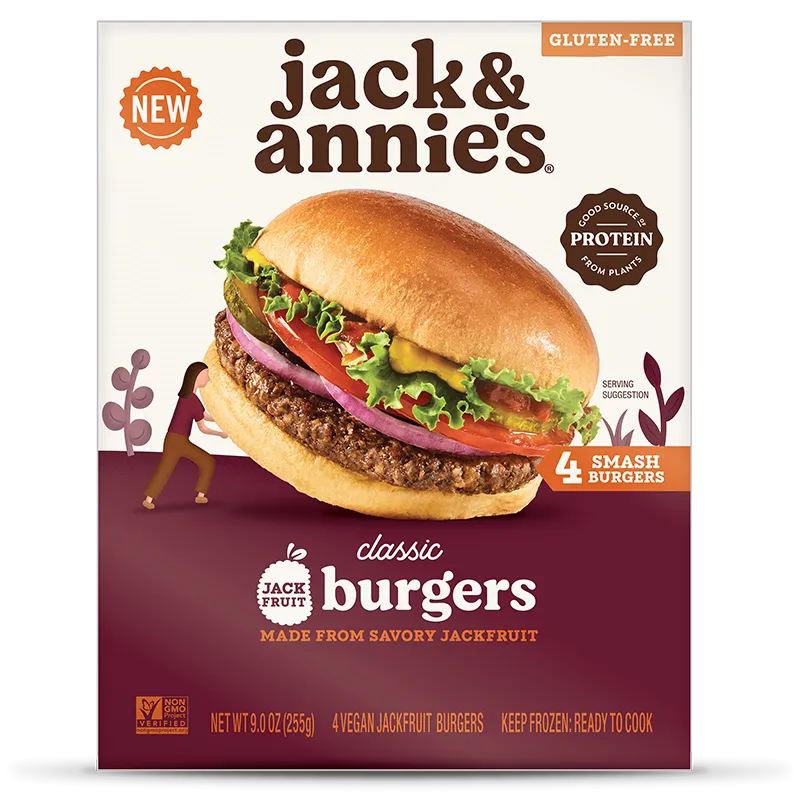

Now with jack & annie’s, launched in 2020, Ryu calls it a “super approachable brand,” featuring 10 easy-to-make frozen food items that have more meaty applications, like crumbles, meatballs and nuggets. Products retail from $4.99 to $5.99 in the frozen space and from $6.99 to $7.99 for refrigerated items.

In the past few years, a few other companies emerged in the plant-based space using jackfruit as a base ingredient. Last year, Singapore-based Karana raised $1.7 million to develop plant-based pork made from the fruit. Upton’s Naturals produces meat alternatives using the fruit, as does The Very Good Butchers and Native Forest.

In less than a year, the brand expanded into more than 1,500 locations in retailers, including Whole Foods, Sprouts, Meijer, Wegman’s, Hannaford, Target and Giant. It is also the third-largest frozen brand in the plant-based category and the top nugget in the natural channel for the 12 weeks ending October 3, according to SPINS Natural Channel, Ryu said.

The company continues to double its revenue on a yearly basis and will use the new funding to continue to build out partnerships and new innovation, expand its footprint on shelves and increase total distribution.

“Jackfruit has the amazing ability to mimic beef, pork, chicken and seafood, so we are at the tip of the iceberg with what we can show,” Ryu added. “Part of what we are doing with leadership is be an innovation partner to major customers, so if they are looking to leverage the meaty texture and to have meat items more delicious with a clear ingredient deck, we can work with them at our R&D center in Boulder.””